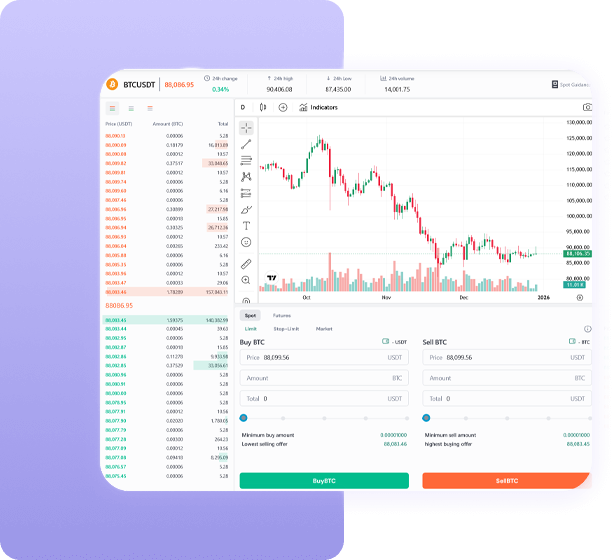

Launching a Centralized Crypto Exchange (CEX) with Javizen

If you’re planning to launch a professional centralized exchange, Javizen supports you from needs analysis and development all the way to setup, deployment, and go-live.

In addition to fully custom development, we also provide a ready-made CEX product that can be tailored to your requirements, helping you enter the market faster and grow with lower risk.

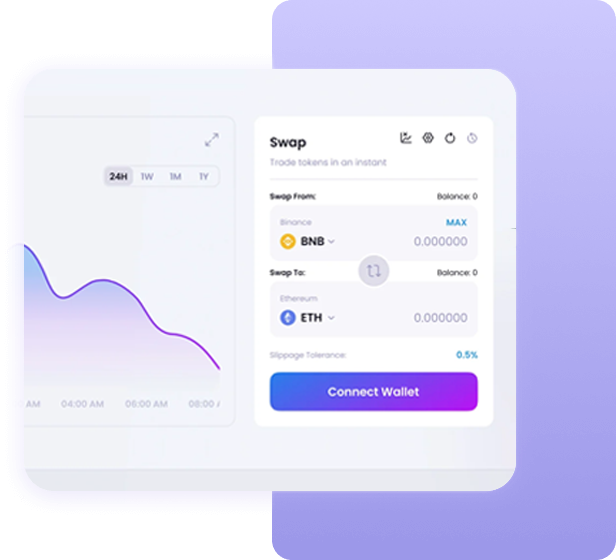

Launching a Decentralized Crypto Exchange (DEX) with Javizen

If you want to launch a secure, fast, and scalable decentralized exchange (DEX), Javizen supports you from design and development all the way through setup, deployment, and go-live.

Alongside fully custom development, we offer a ready-made DEX product that can be tailored to your specific needs, enabling you to enter the market in the shortest possible time.

The smart contracts powering our exchanges are designed according to modern global standards and, in terms of structure, performance, and extensibility, are capable of competing with leading international DEX platforms.

Dedicated Blockchain Development & Web3 Infrastructuren with Javizen

At Javizen, we develop dedicated blockchains with a product-focused, engineering-driven approach — from network and consensus design to token creation, asset tokenization, implementation of financial systems, and development of blockchain-based applications.

Our team supports you end-to-end, from analysis and architecture through testing, deployment, and final launch.

Asset Tokenization & Token Ecosystem Design with Javizen

At Javizen, we handle asset tokenization professionally with a product-focused approach. From creating your token on any preferred network (or your own dedicated chain) to designing the economic model (tokenomics), preparing the whitepaper, and building the project’s landing website, our team supports you end-to-end.

We help turn your idea into a real, launch-ready token ecosystem.

Launching a Prop Trading Platform with Javizen

If you’re planning to launch a professional prop trading platform, Javizen supports you from design and development through setup, deployment, and go-live.

In addition to fully custom development, we offer a ready-made prop trading product that can be tailored to your needs, so you can enter the market faster and define your own challenge models, risk rules, and user growth paths aligned with your brand and strategy.

Our prop solutions are typically built around configurable evaluation/challenge modules, dashboards, and flexible risk management tools.

Launching a P2P Exchange & Trading System with Javizen

If you want to launch a secure, fast, and scalable P2P trading platform, Javizen supports you from design and development all the way through setup, deployment, and go-live.

In addition to fully custom development, we offer a ready-made P2P product that can be tailored to your specific needs, helping you enter the market in the shortest possible time.

If required, the P2P module can also be integrated with your CEX or DEX, giving your users access to a complete trading ecosystem.

Crypto Payment Gateway Development with Javizen

If you want to launch a secure, fast, and scalable crypto payment gateway, Javizen supports you from design and development all the way through setup, deployment, and go-live.

In addition to fully custom development, we offer a ready-made payment gateway product that can be tailored to your needs, so you can have a professional gateway in the shortest possible time.

Launching a Launchpad & Token Offering System (ICO / IDO) with Javizen

If you want to launch a professional token launchpad, Javizen can deliver it either as a fully standalone platform or integrated with your CEX or DEX exchanges.

In addition to fully custom development, we offer a ready-made launchpad product that supports referral systems and can be fully customized based on your requirements.

If needed, the Javizen team can also create your project’s whitepaper and marketing website, and even develop a dedicated Telegram mini app for your token offering.