Additionally, Javizen’s Futures Trading Service offers speculative trading contracts for future asset price movement, often with leverage, to derivative market investors.

Initially designed to offer risk hedging solutions for commodity producers, futures represent a versatile trading tool accessible to traders across various asset classes. Despite their versatility, futures involve significant leverage, necessitating only a fraction of the total position value as margin.

This leverage factor can result in substantial gains or losses compared to the initial capital investment, underscoring the importance of comprehending the associated risks. Consequently, we’ve conducted an in-depth analysis of the top futures trading platforms and brokers to assist you in identifying the most suitable options for your trading requirements.

most popular brokers

Exchange provides expert guidance and support to users at every stage of their trading journey.

To ensure the safety and integrity of user accounts and their deposited funds, we do it.

The trading platform executes or fills users' orders with speed and efficiency.

The connection or integration of the exchange with various financial markets and exchanges around the world.

The provision of valuable information, tools, and data related to the analysis and trading of commodities.

Providing assistance and educational resources to help users navigate effectively on the exchange platform.

Detailed specifications about the contract size, product quality and delivery location and delivery schedule.

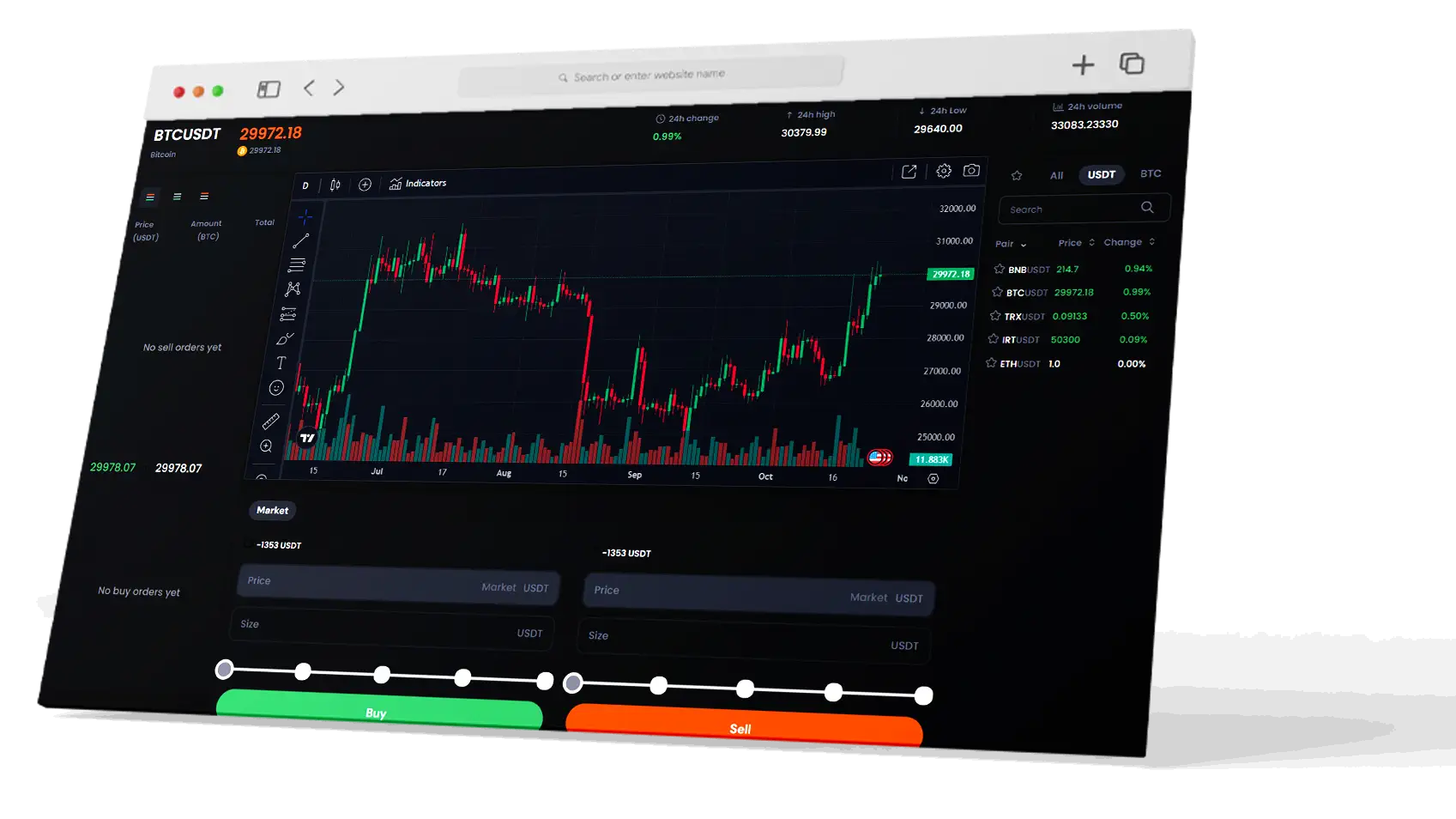

Futures trading service

Do your futures transactions with Javizen script easily and in the shortest time

Futures trading hours vary by market and product, with distinct sessions for different commodities or financial products.

Moreover, financial markets, including stocks, forex, and cryptocurrencies, widely apply margin trading and leverage, enabling investors to borrow funds to magnify potential gains (or losses) on investments.

Furthermore, stop-loss and take-profit orders, vital in trading, help manage and control trade risks and rewards by automatically closing or limiting positions at predefined price levels.

Depositing and withdrawing funds on an exchange can differ based on the exchange and the supported payment methods.

Market volatility gauges the extent of price fluctuations in financial assets or market indices over time, indicating the speed and magnitude of price changes. High volatility signifies rapid and unpredictable price shifts, while low volatility indicates steadier and slower price movements.

Furthermore, a futures contract, commonly traded on exchange platforms, is a standardized financial contract between two parties to buy or sell a specific quantity of an underlying asset at a predetermined price on a specified future date.

Javizen Cryptocurrency Exchange Script

A Script For Creating An Exchange Platform With A Structure Similar To Binance