About Us

Javizen is a specialized team focused on building crypto financial software and blockchain solutions, with over 6 years of experience and collaboration with dozens of startups.

Javizen is a specialized team focused on building crypto financial software and blockchain solutions, with over 6 years of experience and collaboration with dozens of startups.

✔️Included: Future updates

✔️Included: 6 months support from the author

✔️Open Surce

Attributes

| Software Framework | Laravel |

|---|---|

| Files Included | JavaScript JS, HTML, CSS, PHP |

| Software Version | PHP 8.x |

| Compatible Browsers | Firefox, Safari, Opera, Chrome, Edge |

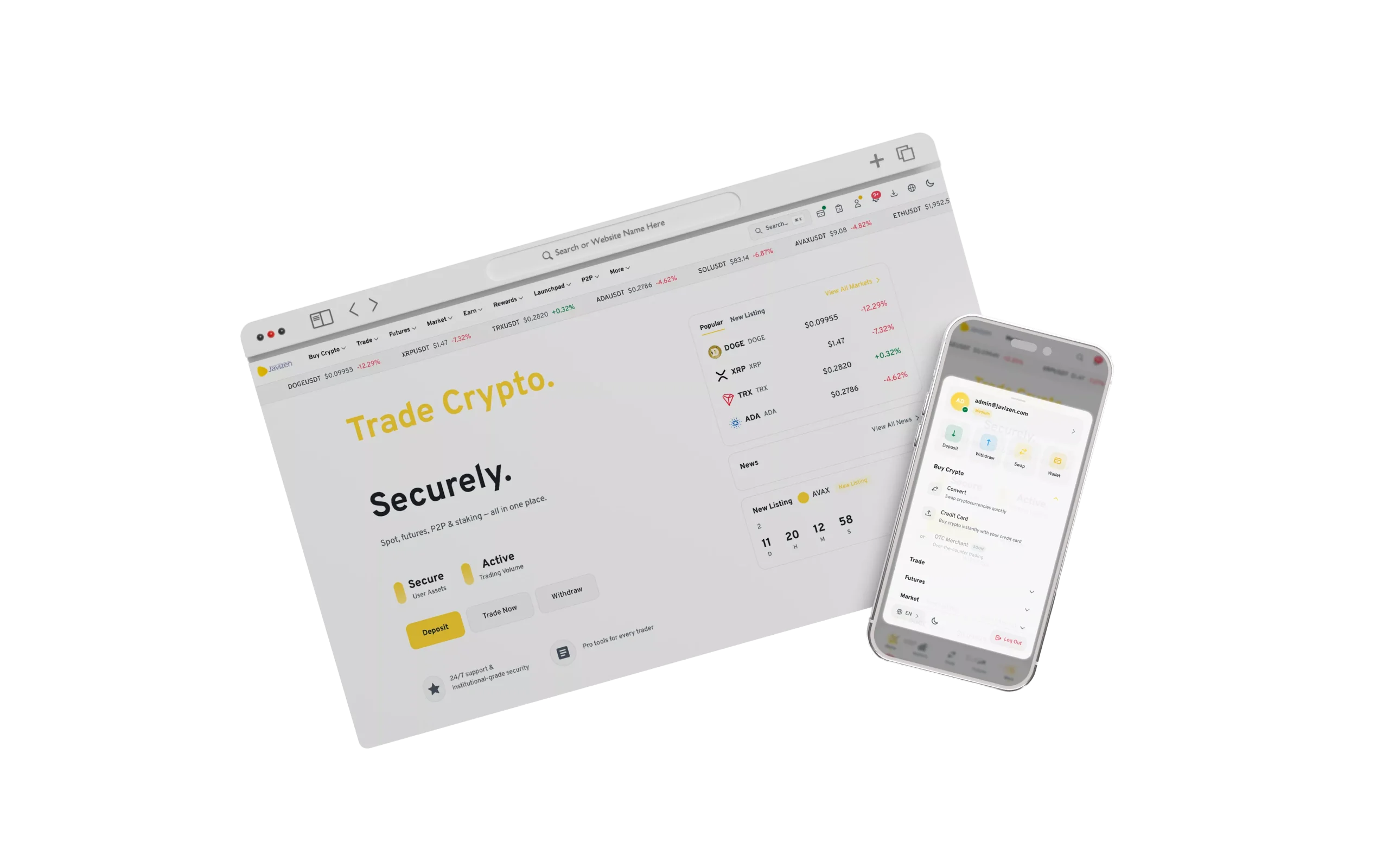

With years of real-world delivery and a specialist team, Javizen is a crypto exchange development company that builds white label crypto exchange software—a fully turnkey crypto exchange platform you can launch fast and scale confidently.

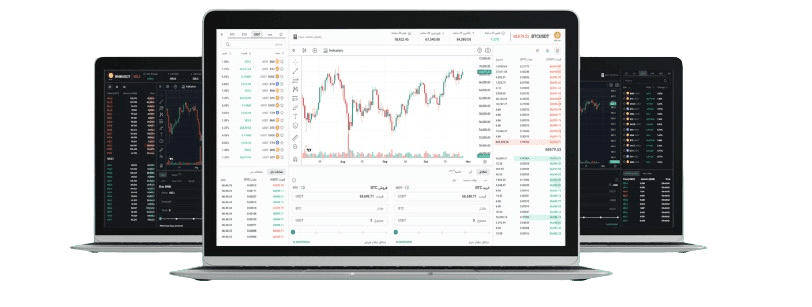

Our crypto exchange software / crypto exchange script includes a high-performance crypto matching engine (an order matching engine for crypto), plus liquidity aggregation via a liquidity API for crypto exchange to connect with a crypto liquidity provider.

You can also extend the platform with crypto market making services, a crypto market making bot, and market maker software for crypto, alongside secure wallet and payment modules.

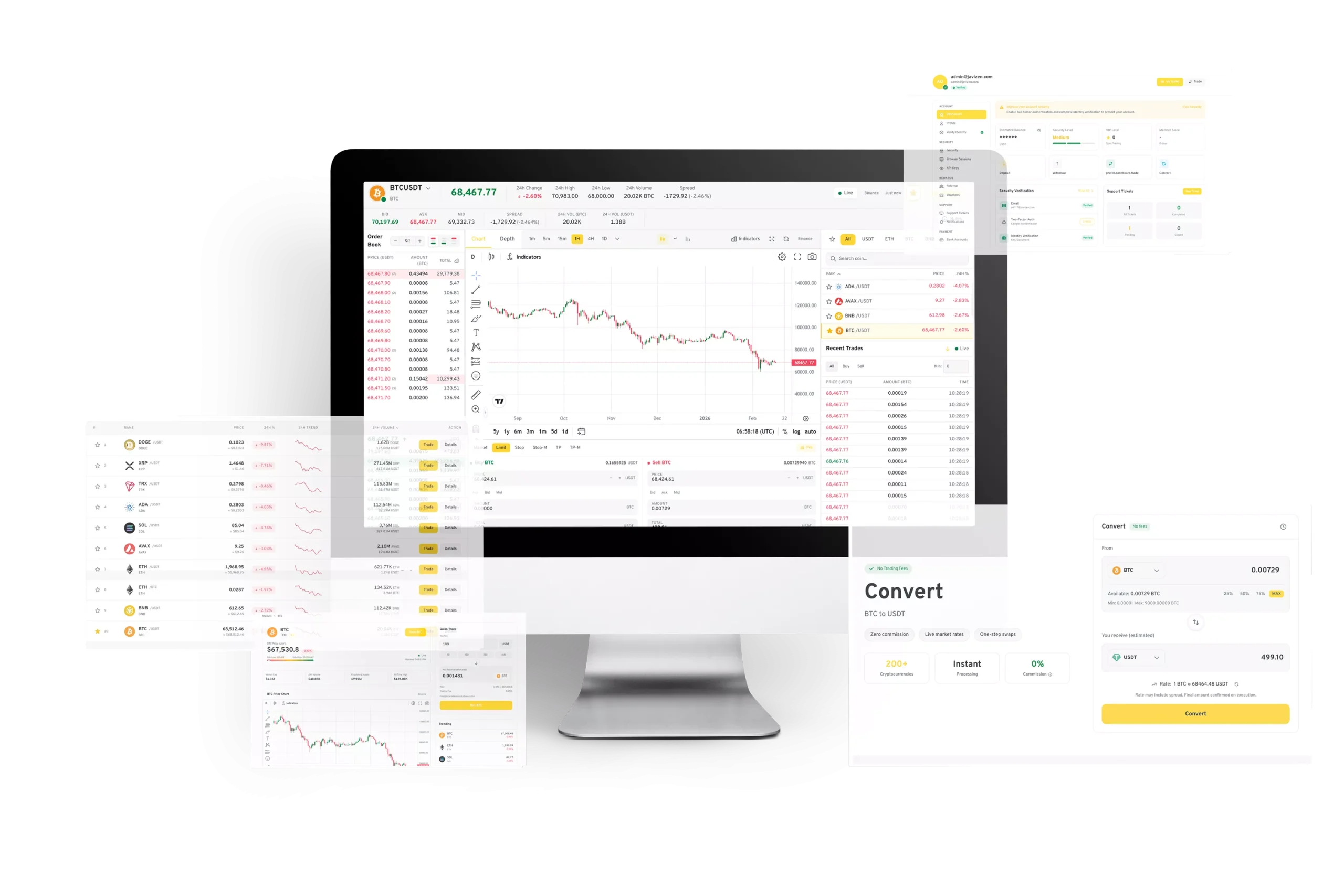

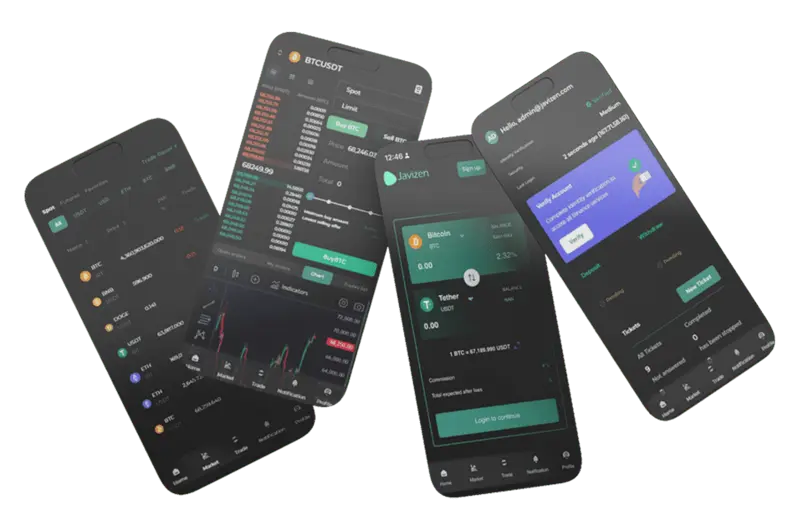

Javizen’s advanced spot trading module lets users trade cryptocurrencies using Market, Limit, and Stop-Limit orders. These order types help traders manage entries and exits more effectively and apply a wider range of trading strategies with greater control.

Javizen can integrate with Binance API and Binance WebSocket feeds to improve market connectivity and enhance liquidity access. This reduces trade execution delays and helps ensure user orders are processed quickly and reliably—delivering a smoother, more professional trading experience.

Javizen’s Swap / Convert feature lets users exchange one cryptocurrency for another in seconds—without placing complex orders. It streamlines the conversion flow, making it faster, simpler, and more user-friendly for everyday trading.

With Javizen Staking, users can lock their crypto assets and earn annual rewards over time. It’s a simple and reliable option for those who want to generate passive income while holding cryptocurrencies.

Javizen’s Launchpad enables emerging crypto projects to run token presales and ICO-style offerings to raise early-stage funding. At the same time, users can join these sales and purchase new tokens before broader market listing, with a clear and streamlined participation flow.

Javizen supports dedicated wallet generation to streamline crypto deposits, withdrawals, and balance management for each user. This improves operational speed and enhances security, while giving exchange operators stronger control over transaction flows—supporting better monitoring, risk reduction, and liquidity management.

Javizen is built to support a broad list of cryptocurrencies and fiat currencies, enabling exchanges to add and manage markets with high flexibility. Users can buy, sell, and convert assets across multiple pairs—creating a smoother, more adaptable trading experience as your exchange grows.

Javizen’s Demo Trading feature lets users practice trading with virtual funds in a risk-free environment. It also includes an automated account top-up flow, so demo balances can be credited instantly—without manual confirmation—creating a smoother learning and onboarding experience.

If you choose installation and onboarding through our support team, the deployment is completed within 5 business days, ensuring a smooth and structured go-live process.

The exchange script is delivered fully open-source, with no code encryption or obfuscation, and includes comprehensive documentation—so your team can review, customize, and maintain the platform with full visibility.

After purchase, customers receive up to 6 months of free support focused on resolving system errors and potential bug logs. For ongoing operations, enhancements, or priority assistance, you can request a dedicated support plan—please contact our team for details.

We follow strong security practices across the platform. Sensitive wallet-related data is secured before storage (hashed and/or encrypted where appropriate) to reduce risk and prevent exposure. That said, security is an ongoing process—so we strongly recommend having a dedicated team to continuously monitor, review, and improve security over time.

Customization is best handled via a scoped backlog/SOW with clear requirements and acceptance criteria. Pricing is typically fixed-scope (milestone-based) or time & materials for iterative work. A solid workflow is design → implementation → staging QA → client approval → production release.

Full exchange website with user dashboard and admin panel

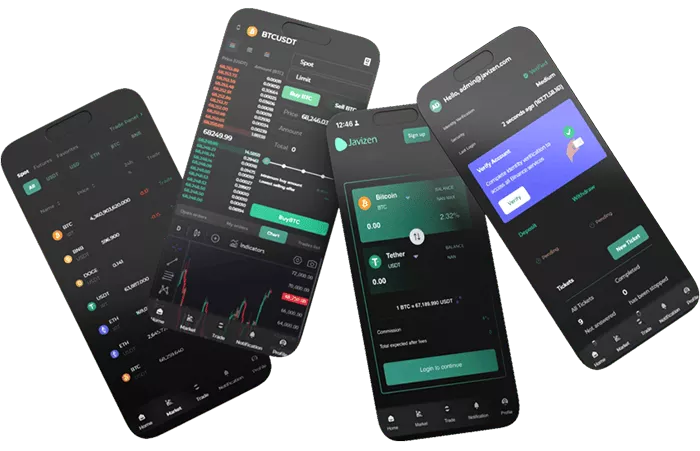

Optimized for mobile, tablet, and desktop screens

Dark mode available across all pages

Visitors can explore the exchange before signing up

Users can use the panel before completing KYC (as allowed)

Admin-controlled maintenance page for updates

Performance-optimized UI targeted for fast load times

Single-step registration to reduce onboarding friction

Account verification via email confirmation

Forgot-password link sent securely by email

Users can change email and password from profile settings

Each user can set a personal default language

Performance-optimized UI targeted for fast load times

Multi-language support across the platform

Enable/disable languages from the admin panel

Add new languages (translation file provided by client)

Bot protection on login and signup pages

Google Authenticator based 2FA with recovery options

QR generator for quick 2FA enrollment

Identity verification via selfie + passport/ID card

Role-based admin access controls (noted as in-progress)

Bot protection on login and signup pages

Google Authenticator based 2FA with recovery options

QR generator for quick 2FA enrollment

Identity verification via selfie + passport/ID card

Role-based admin access controls (noted as in-progress)

Dedicated wallet handling for user asset operations

Detailed deposit/withdraw history per wallet

Intelligent deposit detection and confirmation per chain

Fast balance crediting without manual approvals where applicable

Aggregate wallets into an admin master wallet for treasury

Supports multiple blockchain networks with scalability

Add unlimited blockchain networks beyond defaults

Integrate online payment gateways where supported

Supports card-based methods (Visa/Mastercard) where available

PayPal integration where supported by provider/region

SMS gateway/panel integration for messaging needs

Binance integration support for market connectivity

Socket/WebSocket support for fast data and execution flow

Automated instant buy/sell for selected assets via Binance API

Support for Binance assets where integration allows

Live TradingView charts with indicators and tools

Optional real/fake chart generator for custom coin scenarios

System notifications for key events and actions

Email notifications for deposits/withdrawals and confirmations

Admin approval flow for withdrawal requests

Online chat/support integration (requires external support account)

Monitoring module to track exchange services health

Automatic VIP level assignment (up to 9 levels)

Referral code, link, and user-level tracking

Automated commission calculation based on referral structure

Referral code, link, and user-level tracking

Time-limited, one-time vouchers for wallet top-ups

Public endpoints for assets, prices, and transaction history

Private API for remote services with registration/KYC workflows

Supports providers like CoinPayments and bank/card options (where available)

ERC20, TRC20, BEP20, Bitcoin and more supported